Earl Franklin Peterson was born

January 4, 1903, in Rockford, Winnebago Co., IL, and died 5:15 PM, Monday, February 27,

1961, at Rockford Memorial Hospital, Rockford, Winnebago Co., IL, at age 58.

Buried in Arlington Memorial Park Cemetery,

Rockford, Winnebago Co., IL.

He is the son of Frank E. Peterson of Sweden, and Emma L. Unknown of Sweden.

Verona Mathilda Swenson

was born

June 21, 1907, in Rockford, Winnebago Co., IL, and died January 7, 1980, in San Antonio, Bexar Co., TX,

at age 72. Buried in Sunset Memorial Park, San Antonio, Bexar Co., TX.

She is

the daughter of

Karl Ludwig "Carl" Swenson of Winnebago Co., IL, and

Olga Marie Larson of

Ishpeming, Marquette Co., MI.

Earl Franklin Peterson and

Verona Mathilda Swenson

were married

May 23, 1928, at the parsonage of Emmanuel Lutheran Church, Rockford, Winnebago Co., IL.

Earl Franklin Peterson and

Verona Mathilda (Swenson) Peterson

had two children:

- Patricia Louise "Pat" Peterson:

Born April 3, 1929, in Rockford, Winnebago Co., IL. Married April 5,

1952, in the Gordon Chapel, Rockford, Winnebago Co., IL, to George Reynolds

Bristol: Born December 8, 1929, in Shreveport, Caddo Parish, LA.

- Cynthia Ann "Cindy" Peterson:

Born August 9, 1938, in Rockford, Winnebago Co., IL, Died May 15, 2002, in

the U. S. Consulate, London, England (age 63). Buried in Saint Edmunds,

County Suffolk, England. Married November 2, 1968, in Pusan, South Korea, to

Patrick Raymond Gillen: Born May 14, 1936, in Dover, Strafford Co., NH; Died

October 28, 2001, in Sutton, County Surry, England (age 65).

TIMELINE

Verona Mathilda (Swenson) Peterson is buried Sunset Memorial

Park, San Antonio, Bexar Co., TX.

Thanks to Find-A-Grave for making this

image available.

Earl Franklin Peterson was born January 4, 1903, in Rockford, Winnebago Co., IL.

Verona Mathilda

Swenson was born

June 21, 1907, in Rockford, Winnebago Co., IL.

Verona Mathilda Swenson, about 1907, Rockford, Winnebago Co., IL.

The 1900 U. S. Census taken on June 5, 1900,

shows Adolph

Larson (age 48) born October 1851 in Sweden to Swedish-born parents and having

emigrated from Sweden in 1873 and a Naturalized citizen is an Iron Ore Worker

owning his own home free of a mortgage and is living in the 3rd Ward, City of

Ironwood, Gogebic Co., MI. Living with him is his wife of twenty

years, Matilda Larson (age 48) born September 1851 in Sweden to Swedish-born

parents, and having emigrated in

1880, with 1 of the 7 children born to her still alive. Also living there is his

unmarried daughter, Olga Larson (age

17) born June 1882 in Michigan to Swedish-born parents. Also living in the house

are two boarders.

The 1910 U. S. Census taken on April 25,

1910, shows Karl L. Swenson (age 30) born in Illinois to Swedish-born parents is

a Machine Company Accountant renting his own home for $10/month and is living at

1653 Fifth Avenue, 2nd Ward, City of Rockford, Rockford Twp., Winnebago Co., IL.

Living with him is his wife of four years, Olga M. Swenson (age 27) born in

Michigan to Swedish-born parents, with the only child born to her still alive.

Also living there is his daughter, Verona M. Swenson (age 3) born in Illinois to

Illinois and Michigan-born parents.

The 1910 U. S. Census taken on April

16, 1910, shows F. E. Peterson (age 44) born in Sweden to Swedish-born parents

and having emigrated in 1888 and a Naturalized citizen and first married at age

17 is a

Concrete Contractor owning his own

farm with a mortgage and is living at 1427 Fourth Avenue, 1st Ward, City of

Rockford, Rockford Twp., Winnebago Co., IL. Living with him is his wife, Emma L. Peterson (age

44) born in Sweden to Swedish-born parents and first married at age 17, with 3

of the 4 children born to her still alive. Also living there is his

three unmarried children, all born in Illinois to Swedish-born parents: George

H. Peterson

(age 16); Ethel E. Peterson

(age 11); and Earl F. Peterson (age 7).

The 1920 U. S. Census taken on January 6,

1920, shows Frank E. Peterson (age 54) born in Sweden to Swedish-born parents

and having emigrated in 1889 and becoming a Naturalized citizen in 1895 is a

Concrete Contractor owning his own

home with a mortgage and is living at 1427 Fourth Avenue, 8th Ward, City of

Rockford, Rockford Twp., Winnebago Co., IL. Living with him is his wife, Erma Peterson (age

54) born in Sweden to Swedish-born parents

and having emigrated in 1892 and becoming a Naturalized citizen in 1895. Also living there is his

three unmarried children, all born in Illinois to Swedish-born parents: George Peterson

(age 26), a Furniture Sale Manager; Ethel Peterson

(age 21), a Bank Stenographer; and Earl F. Peterson

(age 17), a Dry Goods Stock Boy.

Earl Franklin Peterson and

Verona Mathilda Swenson were married

May 23, 1928, in Rockford, Winnebago Co., IL.

Earl Franklin Peterson and

Verona Mathilda (Swenson) Peterson after their marriage,

1928.

The 1930 U. S. Census taken on April 11,

1930, shows Karl L. Swenson (age 50) born in Illinois to Swedish-born parents

and first married at age 26 does Public Accounting Accounting and owns his own

home worth $10,000 and is living at 326 Paris Avenue, 1st Ward, City of

Rockford, Rockford Twp., Winnebago Co., IL. Living with him is his wife, Olga M.

Swenson (age 47) born in Michigan to Swedish-born parents and first married at

age 24. Also living there is his unmarried daughter, Helen Swenson (age 6), born

in Illinois to Illinois and Michigan-born parents.

The 1930 U. S. Census taken on April 14,

1930, shows Earl F. Peterson (age 27) born in Illinois to Swedish-born parents

and first married at age 25 is a Building Construction Secretary owning his own

home worth $11,000 and is living at 2310 Oaklawn Avenue, 1st Ward, City of

Rockford, Rockford Twp., Winnebago Co., IL. Living with him is his wife, Verona

N. Peterson (age 22) born in Illinois to Illinois and Michigan-born parents and

first married at age 20. Also living there is his daughter, Patricia L. Peterson

(age 11/12), born in Illinois to Illinois-born parents.

The

1940 U. S. Census taken on April 2,

1940, shows Earl F. Peterson (age 37) born in Illinois, and 5 years ago was

living in the Same Place, and with 4 years of High School, is a married Shipping

Clerk at a Furniture Factory, and who rents his house for $40/month, and is

living at 1114 20th Street, 8th Ward, City of Rockford, Winnebago co., IL.

Living with him are: his wife, Verona M. Peterson (age 32) born in Illinois, and

5 years ago was living in the Same Place, and with 4 years of High School; his

daughter, Patricia L. Peterson (age 11) born in Illinois, and 5 years ago was

living in the Same Place, and with 4 years of School; and his daughter, Cynthia

R. Peterson (age 1) born in Illinois.

Cynthia Ann "Cindy" Peterson, 1950,

Rockford, Winnebago Co., IL.

Cynthia Ann "Cindy" Peterson,

1950.

Patricia Louise "Pat" Peterson

engagement announcement.

The San Antonio Express,

San Antonio, Bexar Co., TX; February 5, 1952

Petersons Reveal Troth

Mr. and Mrs. Earl Franklin Peterson

of Rockford, Ill., announce the engagement and approaching marriage of their

daughter, Patricia Louise, to Lt. George Reynolds Bristol, son of Mr. and Mrs.

Robert S. Bristol of this city. The couple will be married April 5 in Gordon

Chapel in Rockford. The bride-elect was graduated from East Rockford High School

and attended Rockford College. She was graduated from the University of

Illinois, where she was a member of Kappa Gamma Sorority, the Women's Glee Club

and was chairman of the Illini Union Council. She was also a member of the

Rockford Junior Woman's Club. Lt. Bristol was graduated from Texas Military

Institute and the University of Illinois. He served as treasurer of Sigma Chi

Fraternity and was president of the Air Force Rifle Team, junior manager of

intramural sports, secretary of the Air Council and was a lieutenant colonel in

the R. O. T. C. He is at present stationed at Wright-Patterson A. F. B. in

Dayton, Ohio.

The San Antonio Light,

San Antonio, Bexar Co., TX; Friday, March 19, 1954

Craig Reynolds Bristol will be

celebrating his birthday every St. Patrick's day. He was born Wednesday morning

in Nix hospital to Mr. and Mrs. George Reynolds Bristol, and is the grandson of

Mr. and Mrs. Earl Peterson, Rockford. Ill., and Mr. and Mrs. Robert S. Bristol.

The San Antonio Light,

San Antonio, Bexar Co., TX; Thursday, August 25, 1955

S. A. Visit Soon to End

Mrs. Earl Peterson and her daughter,

Cynthia, Rockford, Ill., are spending the month of August here with another

daughter, Mrs. George Bristol, and Mr. Bristol. The visitors will leave Tuesday

for their home.

The San Antonio Light,

San Antonio, Bexar Co., TX; Friday, May 12, 1957

Being welcomed by Mr. and Mrs. George

Bristol and their 3-year-old son, Craig, is their daughter, Cynthia Page, born

April 30. She is the granddaughter of Mr. and Mrs. Earl Peterson, Rockford,

Ill., and the great-granddaughter of Mrs. K. L. Swenson, Rockford. Her paternal

grandparents are Mr. and Mrs. Robert S. Bristol.

Craig Reynolds Bristol

was born March 17,

1954, San Antonio, Bexar Co., TX.

Cynthia Page

Bristol was born April 30, 1957,

San Antonio, Bexar Co., TX.

Kevin George

Bristol was born June 17, 1959,

San Antonio, Bexar Co., TX.

Verona Mathilda (Swenson) Peterson and Cynthia Ann "Cindy" Peterson,

Rockford, Winnebago Co., IL.

Verona Mathilda (Swenson) Peterson and her daughter, Cynthia Ann "Cindy" Peterson.

Earl Franklin Peterson died 5:15 PM, Monday, February 27,

1961, at Rockford Memorial Hospital, Rockford, Winnebago Co., IL, at age 58.

Buried in Arlington Memorial Park Cemetery,

Rockford, Winnebago Co., IL.

Patrick Raymond Gillen and

Cynthia Ann "Cindy" Peterson

were married

November 2, 1968, in Pusan, South Korea.

Patrick Raymond

Gillen and Cynthia Ann "Cindy" Peterson

marriage reception.

Patrick Raymond Gillen and

Cynthia Ann "Cindy" (Peterson)

Gillen and family at Heathfield Lodge, England, about 1965.

Patrick Raymond

Gillen and Cynthia Ann "Cindy"

(Peterson) Gillen and family.

The

Rockford Register-Republic,

Rockford, Winnebago Co., IL, Monday, August 10, 1970

TRAVELERS REPORT

Back from Texas is Mrs. E. G. Lancaster,

415 Warren Ave. She visited a sister, Mrs. Earl F. Peterson in San Antonio,

and also two nieces, Mrs. George Bristol (Patricia Peterson) of San Antonio

and Mrs. Patrick Gillen (Cynthia Peterson). Mrs. Gillen and children, Kerry,

7, and four-month-old Matthew, were en route to join her husband at

Lakenheath Air Base in England. Both Mr. and Mrs. Gillen are civilian

teachers of Army personnel, and spent the past school term in Ankara,

Turkey, where Matthew was born. The Gillens spent the previous year in

Pusan, Korea, where they adopted Kerry, a full-blooded Korean.

Patrick Raymond Gillen and

Cynthia Ann "Cindy" (Peterson)

Gillen and family, Christmas, 1979.

Patrick Raymond

Gillen and Cynthia Ann "Cindy"

(Peterson) Gillen and family.

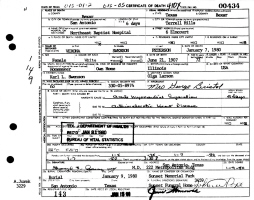

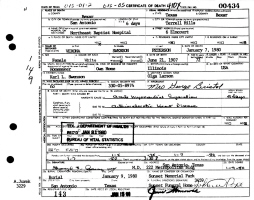

Verona Mathilda (Swenson) Peterson died January 7, 1980, in San Antonio, Bexar Co., TX,

at age 72. Buried in Sunset Memorial Park, San Antonio, Bexar Co., TX.

Verona Mathilda (Swenson) Peterson

Death Certificate.

Pat Bristol

Office: (210) 826-2345

Email: patb29@yahoo.com

Experience: 10 years

Achievements: BBA – UT Austin ’79

Personal: Pat Peterson Bristol, a native of Rockford, Illinois,

graduated from the University of Illinois with a Bachelor of

Arts degree. She did post graduate work in England at Cambridge

University. She has lived in San Antonio for over 40 years and

has sold upscale property in Fredericksburg and Canyon Lake as

well as in San Antonio. Pat is a member of the Junior League,

the Argyle, and is past president of the Southwest Foundation

Forum, Kappa Kappa Gamma Alumnae Association and Veinte y Uno

investment club. Before becoming a REALTOR ®, Pat worked in the

leisure travel business. Clubs / Memberships: Junior League,

Southwest Foundation Forum, Military Civilian, Argyle Club

Education: B.A. University of Illinois

Languages: Spanish

Board of Contract Appeals

General Services Administration

Washington, D.C. 20405

_____________

April 11, 2002

______________

GSBCA 15748-RELO

In the Matter of PATRICK R. GILLEN

Patrick R. Gillen, Suffolk, U.K., Claimant.

Paul Wolfe, Personnel Director, Education Activity,

Department of Defense,

Arlington, VA, appearing for Department of Defense.

DeGRAFF, Board Judge.

Patrick R. Gillen was employed as an educator by the

Department of Defense (DoD)

in Lakenheath, United Kingdom, for more than thirty years. His wife was

also employed by

DoD in Lakenheath. In July 1999, a physician in the United States stated

that Mr. and

Mrs. Gillen were his patients, and that he believed they both qualified for

medical retirement.

In August 1999, Mr. Gillen completed his application for retirement, to be

effective June 24,

1999. Although Mr. Gillen did not report for work after June 1999, he

stated that he did not

want to retire without first obtaining certain information from the Office of

Personnel

Management (OPM) regarding the retirement benefits he would receive. OPM

and DoD told

Mr. Gillen that they could not provide the information he requested until he

provided a

definite retirement date. Mrs. Gillen retired from work effective January

7, 2000.

On January 9, 2000, in a letter to a member of the

United States Senate, Mr. Gillen

made it clear that he wanted his retirement to be effective June 24, 1999.

As a result, on

January 19, 2000, DoD provided Mr. Gillen with a certificate of retirement, and

OPM made

a determination regarding Mr. Gillen's benefits. On June 28, 2000, DoD

prepared separation

travel orders that authorized Mr. Gillen to ship his household goods to the

United States and

to travel to the United States with his wife at Government expense, provided he

began his

travel and transportation within two years from the date of his retirement, that

is to say by

June 23, 2001.

In April 2001, Mr. Gillen asked DoD for an indefinite

extension of time to return to

the United States at Government expense. He explained that he and his wife

had serious

medical problems that were being addressed in the United Kingdom, and that they

did not

have the "emotional or physical strength and stamina" to move back to the United

States.

DoD told Mr. Gillen on April 23, 2001, that applicable regulations imposed a

maximum time

limit of two years for beginning separation travel and transportation of

household goods. In

addition, DoD explained that it lacked the authority to modify or waive the

two-year

deadline. In May 2001, Mr. Gillen wrote to a second member of the United

States Senate,

"Please help us as we need to stay in the United Kingdom because of the medical

care that

we are receiving . . . ."

So far as we can tell from our record, Mr. Gillen's

most recent trip to the United States

was from mid-December 1999, through early January 2000, and Mrs. Gillen's

most recent

trip was sometime after March 1999. In March 2001, Mrs. Gillen's physician

stated that she

would not want to subject her to a change of medical staff or hospital. In

September 2001,

Mr. Gillen explained that he could not travel due to his medical condition.

On January 18, 2002, Mr. Gillen asked us to review

DoD's decision not to grant an

extension of time to ship his household goods and to begin his return travel to

the United

States. Included in Mr. Gillen's submission is a statement that he would

like the deadline to

be extended until January 19, 2003, which is three years after the issue

regarding his

retirement annuity was resolved. DoD points out that there is no authority

to grant

Mr. Gillen's request, and asks the Board to recommend that the General Services

Administration's Deputy Associate Administrator, Office of Transportation and

Personal

Property (MT), grant administrative relief to Mr. Gillen.

Applicable regulations do not permit DoD to pay Mr.

Gillen's travel and transportation

expenses. Agencies may pay travel and transportation expenses of employees

who return

from posts of duty overseas, pursuant to applicable regulations. 5 U.S.C.

5722, 5724(d)

(2000). The regulations, which apply to all federal civilian employees,

provide that all travel

and transportation shall be accomplished within six months of the date of

separation or other

reasonable period of time as determined by the employing agency, but in no case

later than

two years from the effective date of the employee's separation from Government

service. 41

CFR 302-1.106 (2000). The imposition of a time limitation ensures that an

employee's travel

is clearly incidental to the separation and that the travel will begin in a

reasonable time. If

an employee does not return to the United States as the result of the

termination of an

assignment and within a reasonable time, the employee's eventual return should

not be

authorized at public expense. 28 Comp. Gen. 285 (1948). DoD

correctly informed

Mr. Gillen that an agency may not waive the two-year maximum time period.

John W.

Castellani, GSBCA 15428-TRAV, 01-2 BCA 31,515 (citing cases).

In a test program begun on April 28, 2000, the

Administrator of General Services

authorized the Board to refer claims to MT if administrative relief should be

granted for legal

or equitable considerations, but such relief is prohibited by statutory or

regulatory

restrictions. Such claims are commonly referred to as "meritorious

claims." The purpose of

the test program is to allow MT to achieve the same results as it would if the

Meritorious

Claims Act, 31 U.S.C. 3702(d) (Supp. V 1999), were utilized, but in

a more efficient

manner. The standard we use when we consider whether to recommend a claim

for

disposition under the pilot program is as follows:

We will not apply a hard and fast rule when we

determine whether equitable

considerations compel us to conclude that a claim is

meritorious. In reaching

our decisions, we will consider and balance several

factors. At the outset, we

recognize that deeming a claim "meritorious" is highly

extraordinary, since

Government employees are charged with knowledge of all

applicable laws and

regulations and are expected to comply with them.

We will look to see

whether the claim presents equitable considerations of

an unusual nature which

are unlikely to constitute a recurring problem.

We will consider whether an

agency directed an employee to incur the claimed

expenses. We will also

consider whether an agency's actions caused an employee

to incur the claimed

expenses. We may also consider other factors, as

warranted by the

circumstances presented by individual claims.

Roy Katayama, GSBCA 15605-RELO, 01-2 BCA 31,542.

Using this standard to evaluate the facts presented by

Mr. Gillen, we have decided not

to refer this claim to MT for relief. No legal considerations suggest that

this claim is

meritorious. As for equitable considerations, we explained recently that

we have been

convinced that the equities weigh in favor of employees who incur costs due to

agencies'

actions, but not in favor of employees who incur costs because of personal

decisions and who

benefit from the expenditures. See Charles P. Cooluris, GSBCA 15693-RELO

(Feb. 11,

2002) (citing cases). Here, DoD did not delay Mr. Gillen's departure from

the United

Kingdom, and played no role in his decision to continue his and his wife's

medical treatment

in the United Kingdom. Further, if Mr. Gillen's time to begin his travel

and transportation

were extended, the costs incurred to return him, his wife, and his household

goods to the

United States would be for his benefit. In addition, the equitable

considerations involved

here are not unusual, in that other federal employees confronted with personal

problems have

been held to the requirement that travel and transportation must be completed

within the time

required by either the applicable regulations or a travel authorization.

See, e.g., Sherrell M.

Garth, GSBCA 15729-RELO (Feb. 8, 2002); Eugene Leong, GSBCA 13666-RELO

(Mar. 31, 1997); Teresita G. Bowman, B-212278 (Sept. 2, 1983); 62 Comp. Gen. 200

(1983);

Dale R. Moore, B-184676 (Nov. 17, 1975). We are certain that all such

employees

considered their claims to be genuinely meritorious. However, in part

because such claims

are not unusual, they are not so highly extraordinary as to warrant a

recommendation to MT

that administrative relief contrary to explicit regulatory requirements should

be granted.

___________________________________

MARTHA H. DeGRAFF

Board Judge

http://registry.adoption.com/records/393614.html

|